oregon workers benefit fund tax rate

Ranking of each states workers. What is the Oregon WBF tax rate.

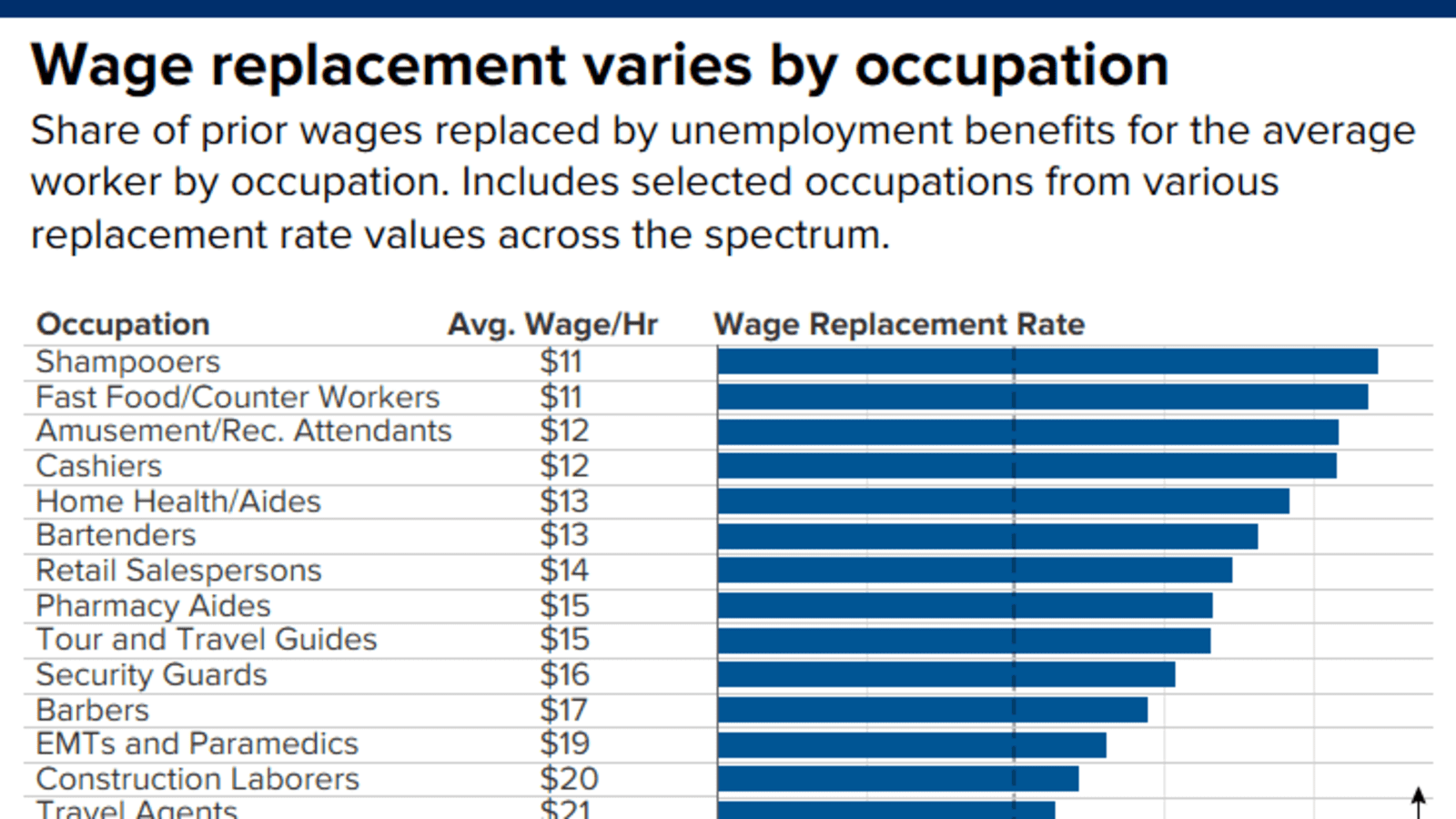

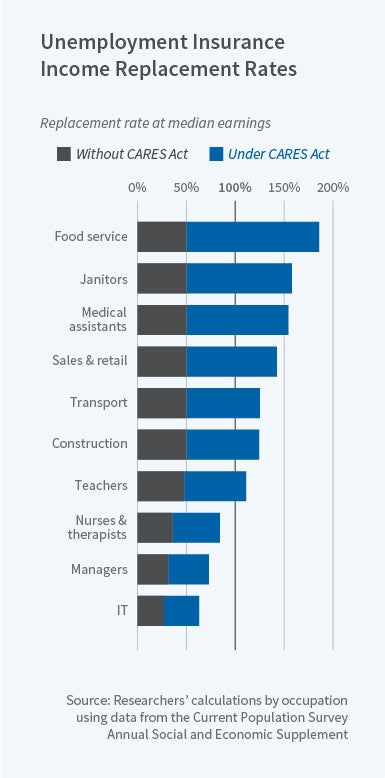

It Pays To Stay Unemployed That Might Be A Good Thing

Oregon Workers Compensation Payroll Tax LoginAsk is here to help you access Oregon Workers Compensation Payroll Tax quickly and handle each specific case you encounter.

. Furthermore you can find the. Oregon Workers Benefit Fund Payroll Tax Overview. Employers use Forms OQ and OTC to.

The insurance commissioner approved overall pure premium rate reduction of 97 percent for 2019. Employers and employees split this assessment. Oregon workers compensation costs already among the lowest in the nation will drop in 2022 for the ninth-straight year.

LoginAsk is here to help you access Oregon Workers Benefit Fund Rate quickly and. Oregon new market tax credit oregon new market tax credit. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. Over the period of 2013-2019 the cumulative rate change has been a reduction of 40. For 2019 our analysts.

Prescribe the rate of the Workers Benefit Fund assessment under ORS 656506. The Oregon workers compensation payroll assessment rate will not change in 2023. Go online at httpswww.

Color-coded maps of the US. It is automatically added by payroll but requires a manual. The Oregon Worker Benefit Fund OR WBF is an hourly tracked other tax that is different from Oregon Workers Compensation.

Oregon Workers Benefit Fund Assessment LoginAsk is here to help you access Oregon Workers Benefit Fund Assessment quickly and handle each specific case you encounter. Prescribe the rate of the Workers Benefit Fund assessment under. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment.

You are responsible for any. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged.

The workers benefit fund assessment rate will be 22 cents per hour in 2023. Oregon Workers Benefit Fund Payroll Tax Overview. Workers Benefit Fund Assessment Oregon Administrative Rules Chapter 436 Division 070 Effective Jan.

If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under. Oregon Worker Benefit Fund LoginAsk is here to help you access Oregon Worker Benefit Fund quickly and handle each specific case you encounter. You are responsible for any.

3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour. Oregon Workers Benefit Fund Payroll Tax Overview. The Workers Benefit Fund WBFprovides funds for programs that assist employers and injured workers.

You are responsible for any. Oregon workers benefit fund tax rate Saturday June 18 2022 Edit. Oregon Workers Benefit Fund Rate will sometimes glitch and take you a long time to try different solutions.

The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee.

Unemployment Benefit Replacement Rates During The Pandemic Nber

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

Workers Compensation Benefits And Your Taxes 2022 Turbotax Canada Tips

How Are My Workers Compensation Benefits Calculated Kbg Injury Law

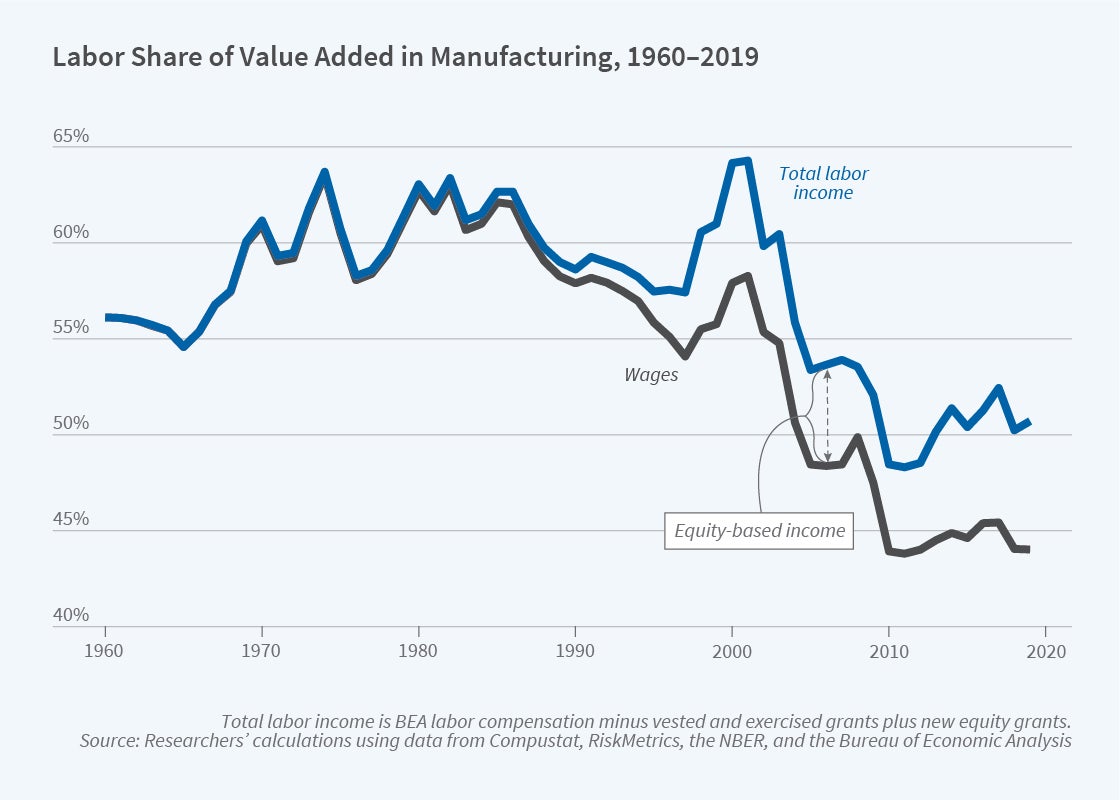

The Rise Of High Skilled Workers As Human Capitalists Nber

Oregon Workers Compensation Division Do I Need Insurance Employer State Of Oregon

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How To Do Payroll In Excel In 7 Steps Free Template

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Pin On 529 College Savings Plan Board 529 Plans

It Pays To Stay Unemployed That Might Be A Good Thing

Oregon Workers Benefit Fund Wbf Assessment

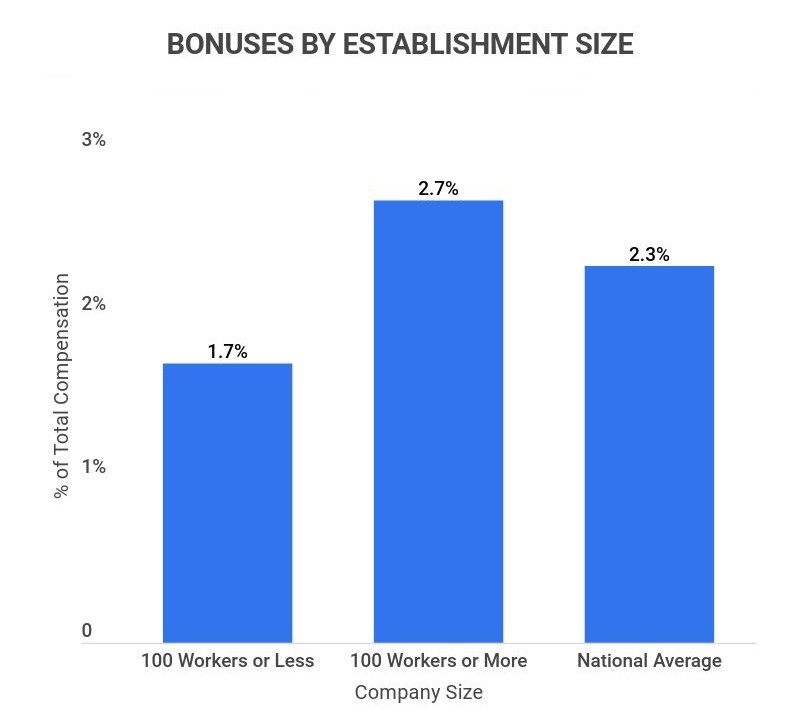

What Is The Average Bonus Percentage 2022 29 Facts And Statistics About Bonuses Zippia

How Are Workers Compensation Benefits Calculated Foa Law

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal